Import-Export Worldwide

Many markets around the world want to be the country supplying goods and products to the US. But the market for imported goods into the US is very strict…

Many markets worldwide aim to become the primary suppliers of goods and products to the US. However, the market for imported goods into the US is quite strict. Some rigorous regulations and standards must be adhered to, including compliance with safety and quality requirements. As a result, companies looking to enter the market need to thoroughly understand these regulations and ensure their products meet the necessary criteria. Building strong relationships with regulatory bodies and staying updated on changes in import laws can also be crucial for success in this competitive landscape.

Here's a more detailed breakdown of the key documents

To ship goods to the US, you’ll need a commercial invoice, a bill of lading, a packing list, and potentially other documents depending on the type of goods. Additionally, for some goods, you may need a certificate of origin, an import license, or other specific permits.

Commercial Invoice:

This is a legal document issued by the seller to the buyer, providing details about the sale, including the quantity, value, and description of goods.

Bill of Lading:

This is a document issued by the carrier (e.g., shipping company) confirming receipt of the goods for shipment.

Packing List:

This document details the contents and packaging of the shipment, helping customs officials verify the goods being shipped.

Certificate of Origin:

This document states the country where the goods were manufactured or produced, often used for tariff purposes.

Import License:

Some goods require an import license to be brought into the US.

Other Documents:

Depending on the specific goods, you may also need documents like an insurance certificate, a letter of credit, or a hazardous materials declaration.

Importer Security Filing (ISF):

For ocean shipments, an ISF is required and provides details about the shipment, including the seller’s name and address, the buyer’s name and address, and the goods’ Harmonized Tariff Schedule (HTS) code.

Customs Entry Form (CBP Form 7501):

This form is required for formal entry of goods into the US and is submitted to the Customs and Border Protection (CBP).

Customs Bond:

A customs bond may be required to ensure that duties and taxes are paid.

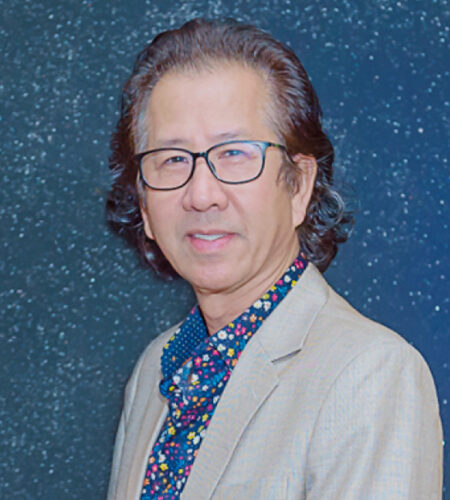

Our Experts Team

Ask Our Leadership